The steel industry is one sector that is bounding back with a vengeance from the prolonged slump brought on by the pandemic. In its early months, closures and the slow implementation of infectious disease management protocols in manufacturing plants severely delayed production.

However, steel mills are now beginning to shift into high gear in the U.S. Unfortunately, they are fighting an uphill battle to make up lost ground.

A few key industries driving the steel comeback include:

Automotive: Demand has increased due to consumers looking to avoid flying and taking public transportation. The growth of the housing market in suburban areas has also impacted the demand for vehicles. This is coupled with individual federal stimulus funds and loan initiatives.

Appliances: Stay-at-home orders and the shut down of workplaces have driven consumers indoors. Wear and tear on home appliances is rising while production has decreased due to cutbacks at manufacturing sites.

Machinery: Spiking consumer demand is putting unexpected wear and tear on commercial machinery. Parts are being replaced at a faster rate because of the rising need for products.

Supply-Chain Setbacks

You may not necessarily associate panic buying with the steel industry. Yet, this area has felt a significant impact from panicked customers. Unpredicted consumer behavior in storing large amounts of household items, such as canned foods, has added increased stress to production lines.

An increase in cooking and home improvement projects has also increased demand for paint, cooking utensils, appliances, and more. So much so, even paint manufacturers don’t even have enough cans in which to store their product.

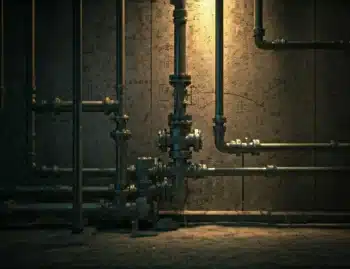

This, and the fact that the steel supply-chain is currently floundering because of plant closings in the spring, ushers in the perfect storm that is causing shortages for manufacturers.

Other sectors that are in need of steel to meet consumer demand are manufacturers of refrigerators, kitchen mixers, and washing machine parts. The rise in home improvement projects has accelerated the need for household products. However, the now slow-moving steel supply is struggling to produce enough to meet the rising peaks of current distribution.

Predictions for Future Normality

Returning to normal production levels will take some time. Both production and utilization levels are 13% lower from last year. Leaders in the sector believe that it could take up to 12 months for stock to be fully replenished and reach normal levels.

The lag in steel production is also a byproduct of instating much-needed COVID-19 measures in steel mills. This requires transforming the workplace and processes in their entirety.

Rehauling production processes to maintain social distancing and integrating enhanced cleaning practices has dramatically decreased productivity. Some manufacturers are opting to reduce the number of workers present at the same time to keep employees safe and avoid outbreaks.

Steel shortages are creating a seller’s market that consumers are struggling to adjust to. On the other hand, companies are anxiously attempting to source steel producers and resorting to using scrap steel, which is also spiking in demand.

Companies that have created a business model that relied on scrap steel, which is normally available, are feeling the impact of these massive shifts within the industry. Climbing prices are already making their presence known in the market. Haggling to achieve the best deal when buying a car may soon become a thing of the past, at least for a while.